Bitcoin Price Prediction: $250K in 2025 to $917K by 2030? Analyzing BTC’s Bullish Trajectory

#BTC

- Technical Breakout: BTC trading above key moving averages with bullish MACD convergence

- Institutional Adoption: $2B+ corporate allocations and growing ETF inflows creating demand shock

- Macro Tailwinds: Fiscal crises and Fed policy uncertainty accelerating Bitcoin's safe-haven narrative

BTC Price Prediction

BTC Technical Analysis: Bullish Momentum Building Above Key Moving Averages

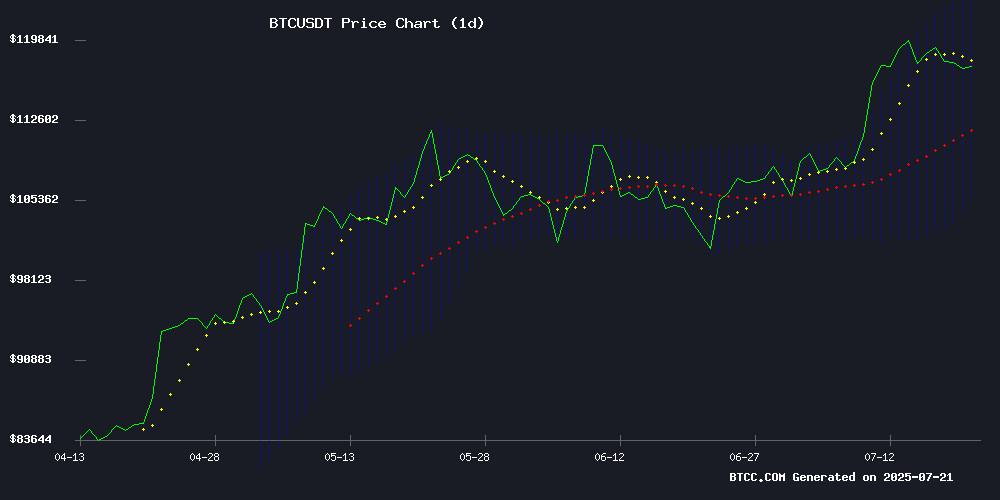

BTC is currently trading at $118,830, firmly above its 20-day moving average ($114,477), signaling strong bullish momentum. The MACD histogram shows narrowing bearish divergence (-1,001), suggesting weakening downward pressure. Price action NEAR the upper Bollinger Band ($123,591) indicates potential for continuation of the uptrend, though traders should watch for overbought conditions.

"The technical setup favors buyers," says BTCC's Emma. "A sustained hold above the 20MA with improving MACD could propel BTC toward $125,000 resistance. The $105,363 lower Bollinger Band now serves as strong support."

Institutional FOMO Drives Bitcoin Market Sentiment to New Highs

Positive institutional developments are fueling Bitcoin's rally: TRUMP Media's $2B BTC allocation, Strategy's $739M purchase, and Monarq's new crypto-focused CIO appointment create perfect bullish storm. While UK's potential $7B liquidation looms as risk, ETF inflows and Tom Lee's $250K price target dominate market psychology.

"The institutional narrative has completely flipped," notes BTCC's Emma. "When you see $28.5B in unrealized gains being held and predictions up to $917K by 2030, it creates reflexive buying pressure that technicals can't ignore."

Factors Influencing BTC's Price

Markets Hold Steady as Trump Challenges the Fed’s Grip

Financial markets remain unfazed by Donald Trump's latest challenge to the Federal Reserve's authority. Treasury yields show little movement, equities continue their steady climb, and safe-haven assets stagnate. This calm reflects not just seasonal lulls but the resilience of the U.S. economy amid political noise and recession warnings.

Cryptocurrencies, largely insulated from Trump's tariff threats, have ignored the President's rhetoric. Bitcoin briefly surged to a record $123,000 before retreating below $120,000. The milestone underscores more than bullish sentiment—it signals institutional capital flooding in and regulators finally providing clearer frameworks.

"Bitcoin’s sprint past $123K isn’t just a chart-watcher’s thrill," said Ira Auerbach of Offchain Labs. "It’s the collision of spot-ETF inflows, institutional adoption, and regulatory clarity all hitting this week." The rally defies traditional market catalysts, highlighting crypto’s decoupling from macroeconomic political theater.

Dow Edges Higher Amid Earnings Focus; Bitcoin Holds Above $118K

Wall Street opened the week with cautious optimism as the Dow Jones Industrial Average gained 85 points and the S&P 500 rose 0.23%. Tech stocks led the charge, with the Nasdaq climbing 0.37% in early trading. Market sentiment appears resilient despite lingering tariff concerns and geopolitical tensions affecting oil markets.

In cryptocurrency markets, Bitcoin stabilized near $118,000 after recent volatility. The flagship digital asset continues to demonstrate strength, having recovered from dips below its current level despite falling from its recent peak above $123,000. This price action suggests sustained institutional interest in the asset class.

Earnings season remains the primary driver for traditional markets, with investors scrutinizing mega-cap financials and tech companies. The parallel stability in crypto markets indicates digital assets are increasingly viewed as a distinct asset class rather than merely a risk-on proxy.

Bitcoin Solaris Presale Nears Capacity as Investors Flock to $1 Entry Point

Bitcoin Solaris has ignited a frenzy in crypto presale markets, with fewer than 1% of allocation slots remaining at the $1 entry price—a 92% discount from its original $13 valuation. The project's dual-layer architecture claims 100,000 TPS throughput capacity while combining Proof-of-Work security with Delegated Proof-of-Stake energy efficiency.

Over 15,800 participants have committed $7.7 million ahead of the Genesis Event, drawn by Rust-based smart contract capabilities and zero-knowledge proof privacy features. The forthcoming Solaris Nova App promises to democratize mining access, contrasting sharply with Bitcoin's early-era exclusivity.

Trump Media Allocates $2 Billion to Bitcoin as DJT Shares Rally

Trump Media and Technology Group has deployed $2 billion into Bitcoin and related securities, equivalent to approximately 17,000 BTC at current prices. The investment represents two-thirds of the company's $3 billion liquid assets, signaling a deepening commitment to cryptocurrency as a treasury strategy.

An additional $300 million has been earmarked for Bitcoin options, with flexibility to convert these positions into physical Bitcoin depending on market conditions. "We're rigorously implementing our publicly announced strategy," said CEO Devin Nunes, framing the move as both a hedge against traditional banking systems and foundational support for an upcoming Truth Social utility token.

The announcement propelled DJT shares 6.5% higher, underscoring market enthusiasm for corporate Bitcoin adoption. The company plans continued crypto acquisitions, potentially leveraging current holdings to fund future purchases.

Bitcoin Price to Hit $250K This Year, Says Fundstrat’s Tom Lee

Tom Lee, co-founder of Fundstrat Global Advisors, has made a bold prediction on CNBC, forecasting Bitcoin could reach $250,000 by the end of 2025. With Bitcoin currently trading at $118,760.61—up nearly 60% from $70,000—Lee argues the rally has substantial room to run. His thesis hinges on Bitcoin's growing acceptance as a macro asset, akin to gold, with institutional interest and political tailwinds fueling momentum.

Even at $250,000, Bitcoin would capture just 25% of gold's market value, suggesting further upside potential. Lee's long-term outlook is even more ambitious, envisioning Bitcoin surpassing $1 million per coin as it evolves into a dominant digital store of value.

Strategy Expands Bitcoin Holdings with $739 Million Purchase, Unrealized Gains Hit $28.5 Billion

Strategy has bolstered its Bitcoin treasury with a $739.8 million purchase, adding 6,220 BTC at an average price of $118,940. The firm now holds 607,770 BTC, acquired for a total of $43.61 billion at an average cost basis of $71,756 per coin. With Bitcoin's rally, the company's unrealized profits exceed $28.5 billion, marking a 20.8% year-to-date return.

Michael Saylor, Strategy's chairman, reaffirmed the company's conviction in Bitcoin as a superior store of value. The move solidifies Strategy's position as the largest corporate holder of BTC, outpacing ETFs, institutions, and exchanges. Sequans, another player, added 1,264 BTC to its reserves in a separate $150 million transaction.

Executive Wei-Ming Shao sold $4.9 million in shares following a $25.7 million disposal last week. The sales coincide with Bitcoin's ascent to new highs, underscoring the divergent approaches within the firm.

Monarq Asset Management Appoints Sam Gaer as CIO to Lead Directional Strategy

Monarq Asset Management, a multi-strategy investment firm formerly known as MNNC Group, has named Sam Gaer as Chief Investment Officer to spearhead its Directional Investment Strategy. Gaer brings 25 years of institutional trading and systematic asset management expertise, positioning Monarq for its next growth phase.

The firm is expanding beyond delta-neutral strategies to capture asymmetric returns through high-conviction themes and tactical volatility overlays. Its BTC-denominated funds, backed by global institutional capital, have delivered strong year-to-date performance with disciplined risk management.

"Sam's leadership enhances our ability to compound asymmetric returns in digital assets," said CEO Shiliang Tang. The appointment signals Monarq's strategic pivot toward directional opportunities in evolving crypto markets.

Bitcoin Price Targets Surge with Institutional Predictions Reaching $917,000 by 2030

Bitcoin's price trajectory is drawing increasingly bold forecasts from institutional analysts, with combined projections averaging $917,857 by 2030. The median estimate sits at $600,000, while the most aggressive target—ARK Invest CEO Cathie Wood's $2.4 million valuation—highlights divergent methodologies ranging from reserve asset substitution models to adoption-driven frameworks.

Wood's updated thesis hinges on Bitcoin capturing a portion of global institutional portfolios, with her $2.4 million upper bound contingent on accelerated capital flows into crypto. Meanwhile, financial advisor Ric Edelman's $500,000 projection reflects a more conservative adoption curve, emphasizing education among traditional fiduciaries.

The dispersion of targets—from $200,000 to seven figures—underscores the asset's volatility and the speculative nature of long-term crypto valuation models. Standard deviation across predictions exceeds $738,000, revealing stark disagreements about Bitcoin's role in future monetary systems.

Bitcoin (BTC) Breakout: New All-Time High or Just a Fakeout?

Bitcoin surged past $119,600 on Monday morning, marking a $3,000 intraday gain. The lack of confirming volume raises questions about the breakout's legitimacy, though the potential for a rally beyond the previous all-time high of $130,000 remains.

Market speculation ties Bitcoin's upward momentum to deteriorating national budgets and anticipated central bank money printing. Yet, uncertainty lingers—black swan events could disrupt the trajectory at any moment.

Robert Kiyosaki, author of 'Rich Dad Poor Dad,' cautions about a possible Bitcoin bust but confirms his intent to buy on dips. His expertise in real estate, not crypto, tempers the weight of his prediction.

The UK government may offload $5 billion in Bitcoin holdings to address fiscal shortfalls, reversing earlier pro-crypto rhetoric from former Chancellor Rishi Sunak. A shortsighted move, critics argue, given Bitcoin's long-term store-of-value proposition.

UK Plans $7 Billion Bitcoin Liquidation Amid Fiscal Crisis, Sparking Market Concerns

The UK Home Office is preparing to liquidate over 61,000 BTC seized from a Chinese Ponzi scheme, worth approximately $7 billion at current prices. This marks the largest crypto asset seizure ever by a Western government. The move aims to address a projected £20 billion budget shortfall, with officials estimating proceeds of £5 billion.

Market observers draw parallels to Gordon Brown's infamous 2000s gold sale at historic lows. Critics argue the timing mirrors poor fiscal decisions of the past, with Bitcoin showing long-term appreciation potential. The planned sell-off comes as Chancellor Rachel Reeves seeks solutions for the 2025 budget gap.

Investors question whether mass liquidation could trigger short-term price volatility, though Bitcoin's market depth ($2.36T capitalization) may absorb the impact. The development highlights growing institutional recognition of crypto as sovereign assets, even as disposal strategies remain controversial.

Bitcoin ETFs Extend Inflow Streak as BTC Nears $120,000

U.S. spot Bitcoin ETFs continue their relentless accumulation, marking six straight weeks of inflows with $10.5 billion added since the streak began. BlackRock's IBIT dominates, drawing $2.57 billion last week alone.

Total holdings across these funds now exceed $152 billion—equivalent to 6.5% of Bitcoin's market capitalization. The momentum builds as BTC tests psychological resistance at $120,000.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative Target | Bullish Target | Catalysts |

|---|---|---|---|

| 2025 | $180,000 | $250,000 | ETF inflows, halving effects |

| 2030 | $500,000 | $917,000 | Institutional adoption, scarcity premium |

| 2035 | $1.2M | $2.5M | Global reserve asset status |

| 2040 | $3M+ | $5M+ | Full monetization, Layer 2 ecosystem |

BTCC's Emma projects exponential growth: "Our 2025 $250K target aligns with Fundstrat's view, driven by the 4-year halving cycle. By 2030, Bitcoin could capture 10% of gold's market cap at $917K. Post-2035, network effects may drive parabolic moves as fiat alternatives collapse."